Apple Pay Later will be expanded to all eligible iPhone users in the U.S. in the "coming months," according to Apple.

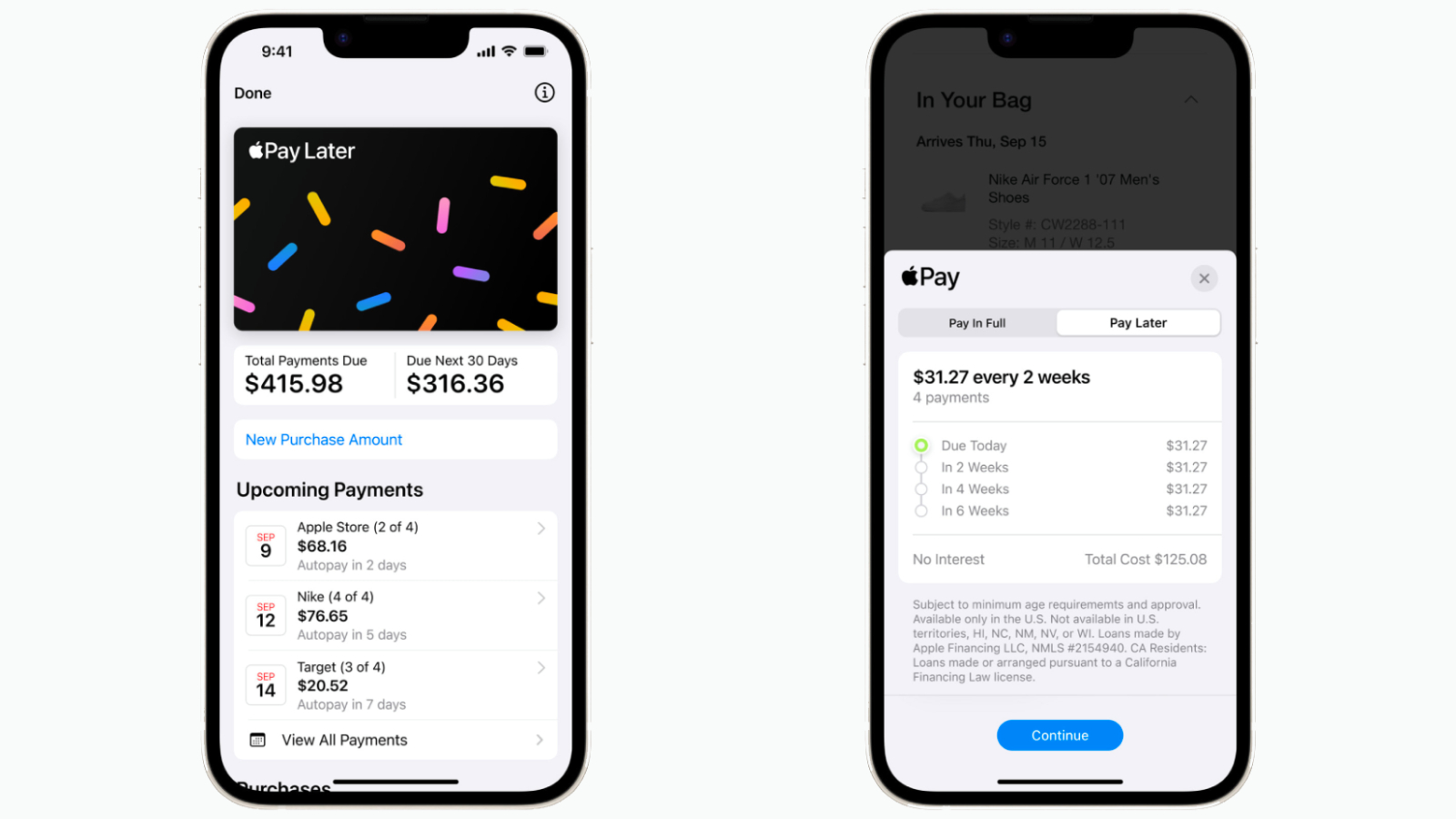

Announced at WWDC 2022 last June, Apple Pay Later is a "buy now, pay later" financing option that lets qualifying customers in the U.S. split a purchase made with Apple Pay into four equal payments over six weeks, with no interest or fees to pay. Users can apply for Apple Pay Later loans of $50 to $1,000 to be used towards online and in-app purchases made with Apple Pay on the iPhone and iPad, according to Apple.

iPhone users can apply for a loan in the Wallet app with no impact to their credit. After entering the amount they would like to borrow and agreeing to the Apple Pay Later terms, a soft credit check will be initiated during the application process. After a user is approved, Apple Pay Later will be available as an option when using Apple Pay.

Apple Pay Later is built into the Wallet app on the iPhone, allowing users to view, track, and manage loans in one place. Users can view upcoming payments on a calendar and choose to receive upcoming payment notifications via the Wallet app and email. Users must link a debit card as their loan repayment method, with credit cards not accepted.

Apple Pay Later credit assessment and lending is handled by Apple Financing LLC, a subsidiary of Apple. The service is based on the Mastercard Installments program, so merchants that accept Apple Pay do not need to do anything to implement it.

Related Roundup: Apple Pay

Related Forum: Apple Music, Apple Pay/Card, iCloud, Fitness+

This article, "Apple Pay Later Available on Limited Basis Starting Today, Launching Widely in Coming Months" first appeared on MacRumors.com

Discuss this article in our forums

0 comments:

Post a Comment