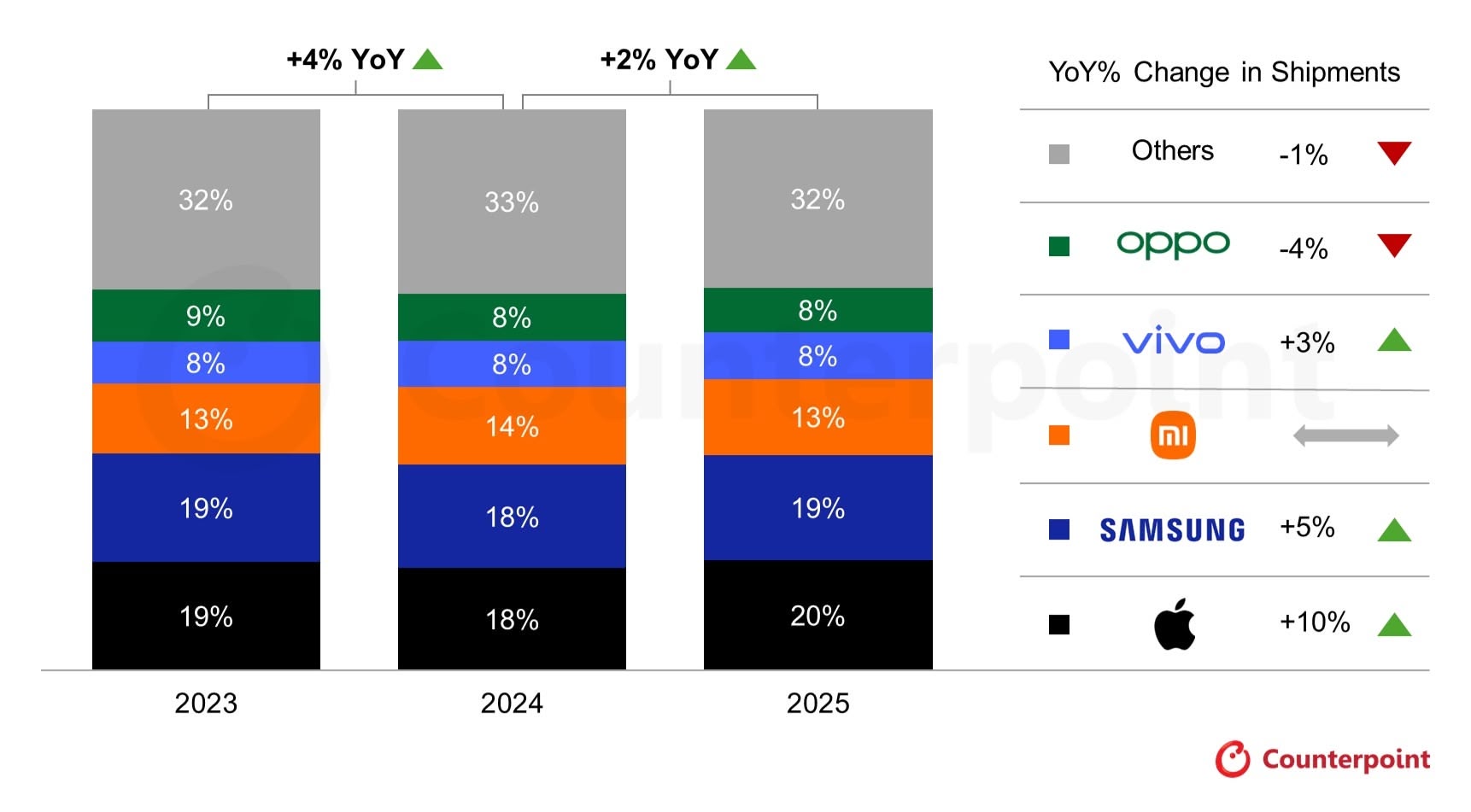

Global smartphone shipments grew 2% year-over-year in 2025, marking the second consecutive year of growth. Counterpoint said the market was driven by more consumers taking advantage of financing options to upgrade to premium devices, as well as increasing adoption of 5G devices in emerging markets.

Samsung ranked second behind Apple with a 19% market share and modest 5% shipment growth, while Xiaomi retained third place with 13% share.

"Apple's growth in 2025 was driven by its expanding presence and rising demand across emerging and mid-size markets, supported by a stronger product mix," said Counterpoint senior analyst Varun Mishra.

"The iPhone 17 series gained significant traction in Q4 following its successful launch, while the iPhone 16 continued to perform exceptionally well in Japan, India and Southeast Asia."

Apple's performance was said to have been amplified by the pandemic-era upgrade cycle reaching an inflection point, with millions of users due for device replacement. In Q4 2025, Apple accounted for one-quarter of global shipments, its highest-ever quarterly share, according to the report.

While U.S. tariff concerns prompted manufacturers to front-load shipments in the first half of the year, the impact actually proved milder than anticipated, and the effects on second-half volumes were limited.

However, Counterpoint's outlook for 2026 is more conservative. "The global smartphone market is set to soften in 2026 amid DRAM/NAND shortages and rising component costs, as chipmakers prioritize AI data centers over smartphones," said Counterpoint research director Tarun Pathak. The firm has subsequently revised its 2026 forecast downward by 3%, although Apple and Samsung are expected to remain resilient thanks to their stronger supply chain capabilities.

Tag: Counterpoint

This article, "Apple Tops 2025 Smartphone Market With 20% Share, 10% Growth" first appeared on MacRumors.com

Discuss this article in our forums

0 comments:

Post a Comment